If you have identified the need to upgrade, expand or replace your commercial HVAC equipment, now just might be your best time to act!

Benjamin Franklin said there are only two things certain in life: death and taxes.

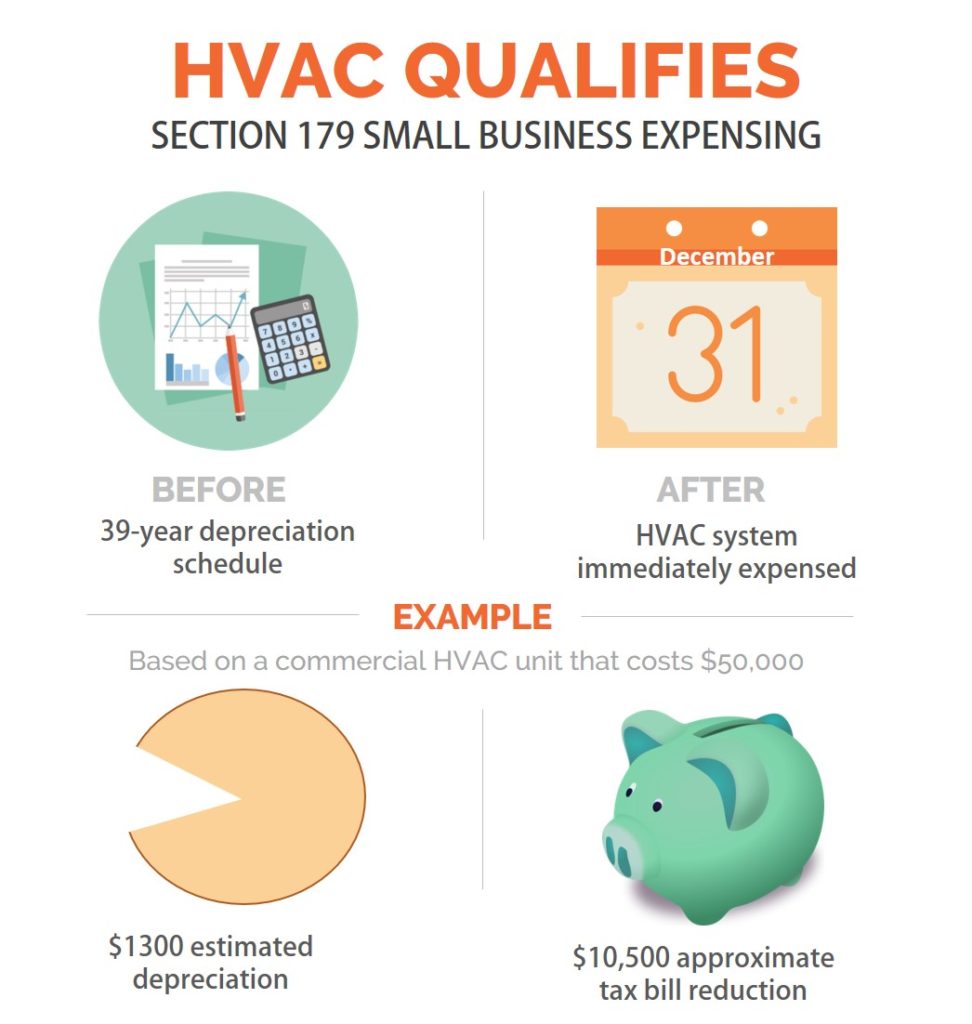

While unfortunately, death is still very much a sure thing, tax rules are ever-changing. Since 2018, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

This means if you purchase or finance HVAC equipment before year-end, you can deduct the FULL PURCHASE PRICE from your gross income in 2022 if you:

- put it into service before December 31, 2022 and

- your total deduction is limited to $1,000,000 for 2022.

There is no guarantee that this same year full deduction (or your tax rate for that matter) will continue in the future.

Review your unique situation with your accountant. If it is determined that you would benefit from taking this deduction in 2022, contact us soon to get on our Q4 2022 installation schedule.

As of now, our schedule has some excess capacity and lead times on most equipment make it highly probable that we can put your project into service before year-end. But you will need to act soon if you want to take advantage of the tax benefit this year. There are also some favorable financing options that you can take advantage of if you chose to go that route.

*Savings Example: (your unique tax situation may vary)

If your project requires $50,000 of HVAC equipment and installation, assuming your tax bracket was recently cut from 35% to 21%, your business could save up $10,500 after deductions in 2022. This would effectively reduce the true cost of the HVAC project to $39,500. We all know that the election outcome could drastically change things after 2022.

*Note: In order to elect to take the deduction, you’ll need to fill out Part 1 of IRS form 4562. Consult your accountant for more information on your unique situation.